tax saver plans in india

Protection for family at an affordable price. Interest Income on Saving Account Tax Saving Under Section.

Best Tax Saving Investments In Fy2020 21 Bajaj Markets

Since ppf is backed by the government it is one of the safest.

. One can save their taxes by investing in one or more of the following tax saving plans from. 15 years Public Provident Fund account. Invesco India Tax Plan.

In addition we take pride in our ability. Tax Saving Plans in India. ICICI Prudential Value Discovery Fund.

80TTA80TTB Max Tax Saving Limit Rs. The loan facility can be availed under the LIC Jeevan Umang plan. This plan is best suitable for individuals who have a low-risk appetite and want to save money over a long-term period.

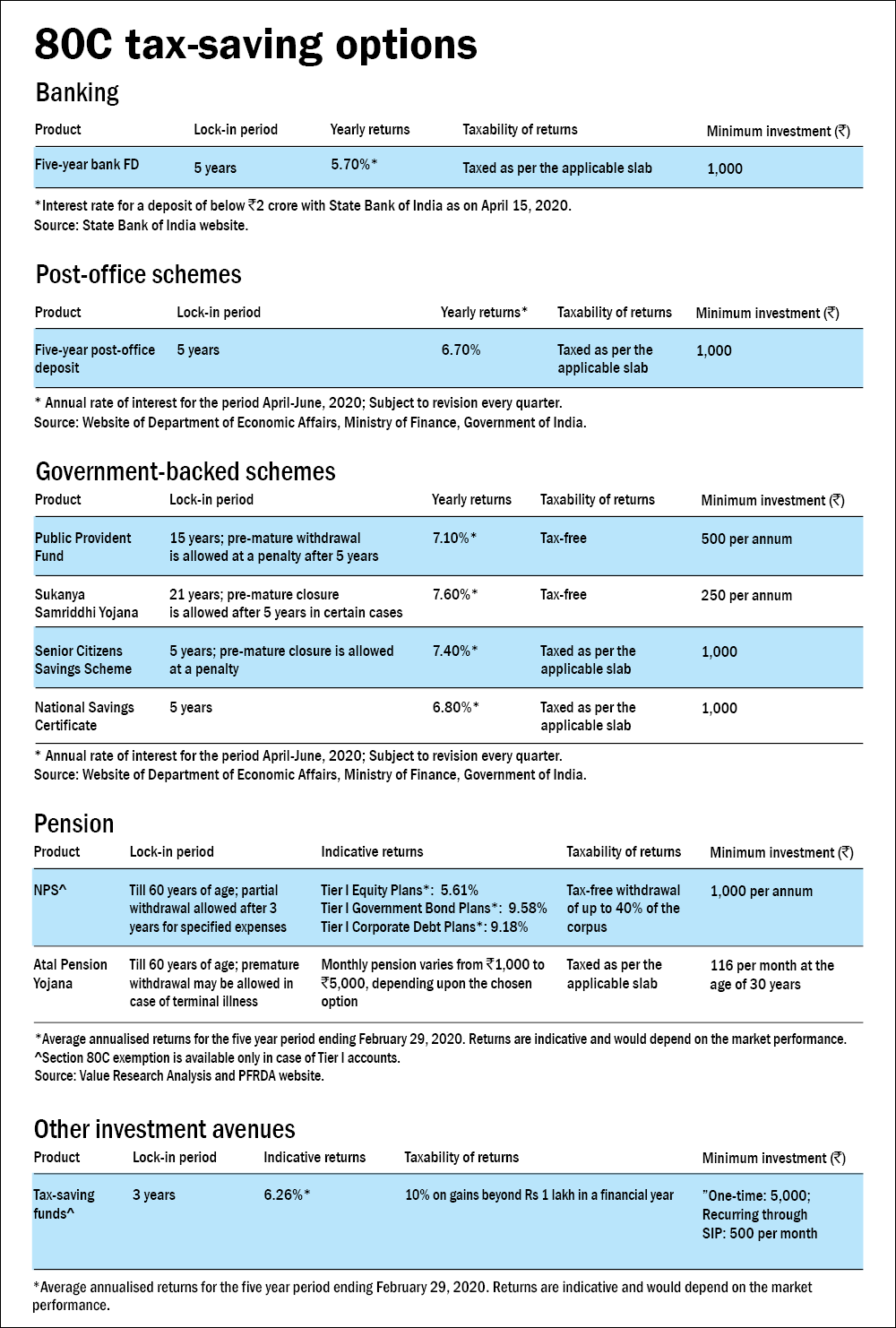

As a tax-saving investments plans the bank FD offers tax-free income. Being a fixed return and low-risk. Additionally it has provided decent returns in.

Tax saving instruments and sections therein. We are a business that firmly believes in hard work integrity compliance and commitment to customer satisfaction. Invest in appropriate tax saver schemes.

PPF is a great tax saving option as it qualifies for deduction upto Rs 15 Lakhs per annum under section 80C of the Income tax act. 8 Tax-saving fixed deposits. Investment up to Rs150000 every year is eligible for tax deduction under Section 80C of The Income Tax Act.

In this article you will get to know about some of the best LIC tax-saving plans to invest in 2021. Welcome to TaxSaver Plan. Welcome to TaxSaver Plan.

Axis Long Term Equity. Claim tax deductions on medical expenses health insurance premiums. Get returns at critical milestones.

ELSS is a highly suitable Tax Saving investment scheme because it is covered under 80C of the Income Tax Act with a tax exemption limit of Rs. LIC Jeevan Anand is the best Tax Saving Plan in India. As mentioned it is a tax saver ELSS Equity Linked Saving Scheme launched on 31 March 1996.

Tax saver plans in india. An aggregate deduction upto 15 lakhs is possible each year. Section 80C 80CCC and 80CCD.

Investment Plans for High Returns September 29 2022. Franklin India Equity Fund. Compare best saving plans start saving from.

The policyholder can take a loan up to 90 of the surrender value after the completion of 3 years of the policy provided the. Avail health insurance plan. DSP Tax Saver.

Avail tax benefits on a home loan. What is Large Cap Fund Overview Features Advantages. 10000 under TTA and Rs.

Motilal Oswal Long Term Equity Fund. Best Investment Options in India 2022. Firstly under section 80c 80ccc and 80ccd you can get a deduction for a maximum of rs.

8 Tax-saving fixed deposits. A lot of saving plans in India also works as a tax-saving investment option. You can save tax by investing in tax saver Fixed Deposits which can fetch you tax deduction under section 80C of.

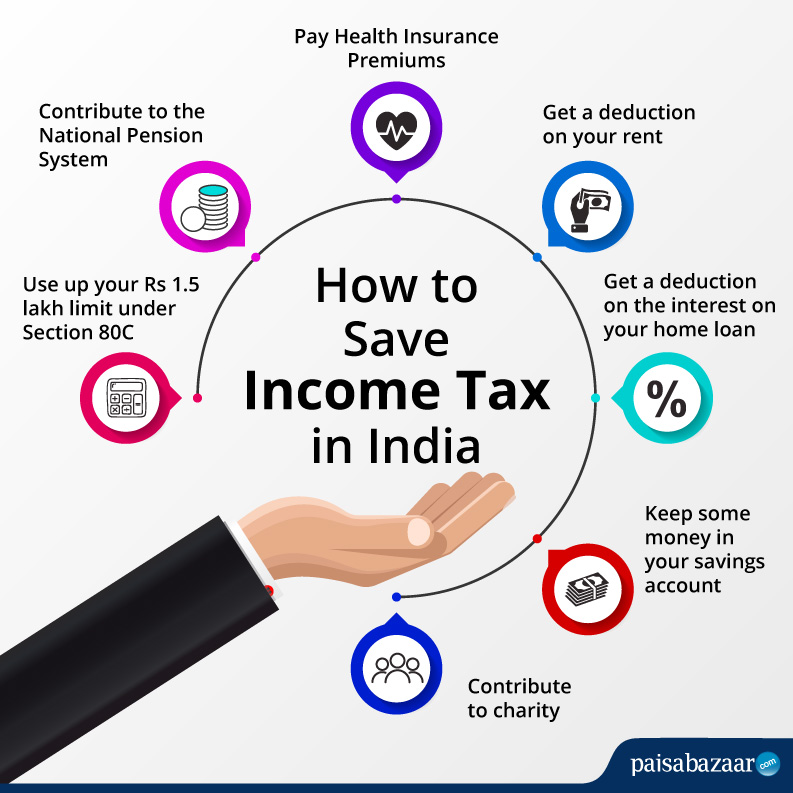

Following are some of the best tax saving investment options under Section 80C of the Income Tax Act 1961. 35 Easy Ways to Save Income Tax in India 202 1 1. Starting a monthly SIP for long-term gets you a lifetime guaranteed tax.

Option to choose between 4 Portfolio Strategies.

Elss Mutual Fund Best Tax Saving Mutual Fund Investment In India

Tata India Tax Savings Fund Direct Plan Best Elss Tax Saving Funds Under Section 80 C Youtube

Best Tax Saving Mutual Funds Schemes To Invest In 2020

Income Tax Deductions Exemptions Under Sections 80c 80d 80ddb

Tax Saving Best Tax Saving Investment Plan In India Reliancesmartmoney Com

10 Best Income Tax Saving Schemes And Plans In 2022 Information News

How To Save Income Tax On Salary Tax Saving Schemes Paisabazaar

Your Tax Saving Action Plan Value Research

Tax Saving Investments Double Benefit Here Are 6 Tax Saving Investments With Tax Exempt Returns The Economic Times

Income Tax Planning Best Tax Saving Options Under Section 80c Right Products To Save Tax Beyond 80c India Com

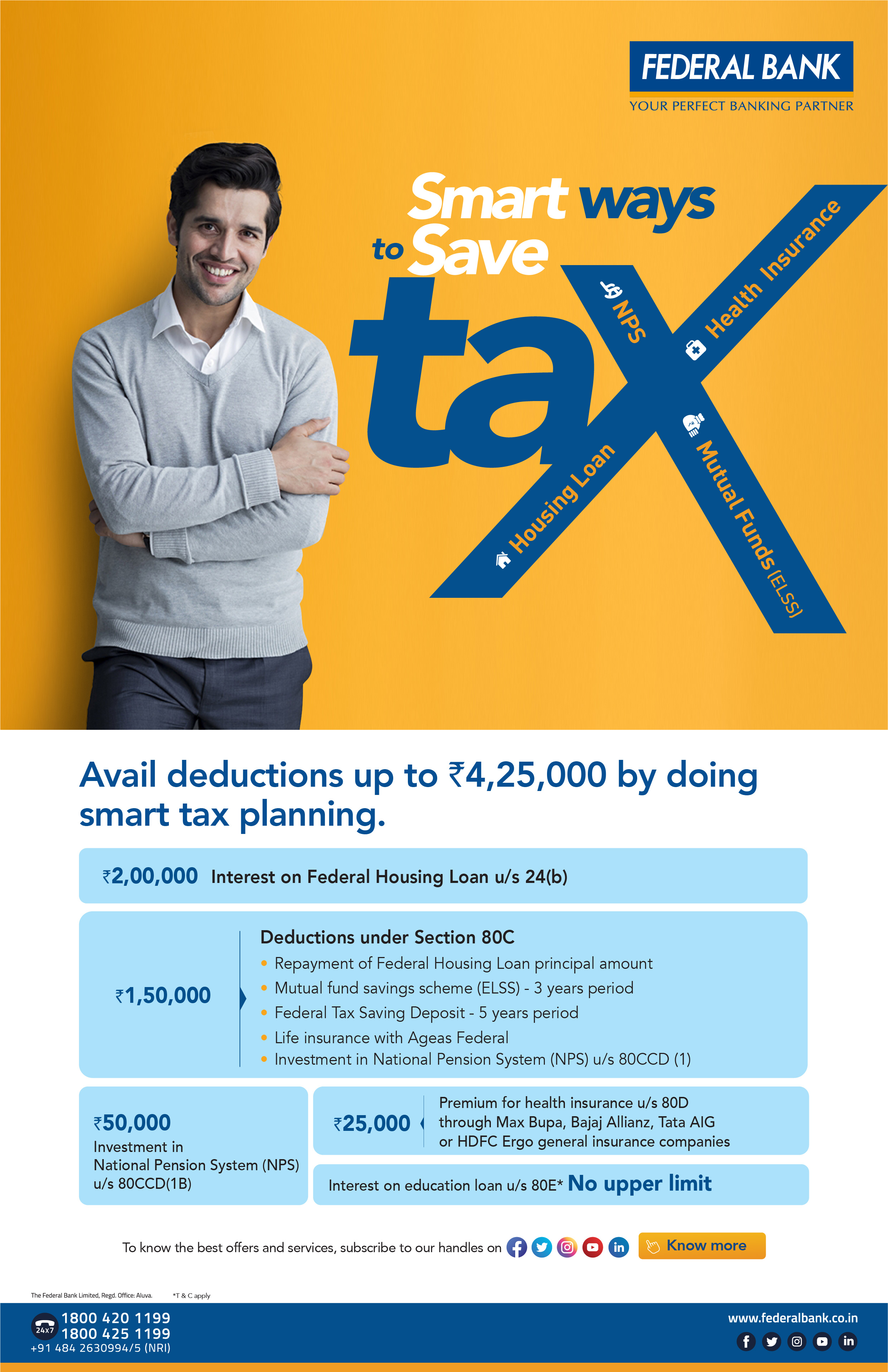

Tax Planning Strategies Federal Bank Tax Saving Investment Plan India

Tax Saving Investments Best Tax Saving Investments Under Section 80c

Best Investment Plan In India For Short And Long Term

Mutual Funds Invesco India Tax Plan Mutual Fund Review Tax Saving Elss With Healthy Long Term Track Record The Economic Times

Best Income Tax Saving Investment Options In India Eztax

Tax Saving Efficient Tax Saving Investments Under 80c Reliancesmartmoney Com

Best Tax Saving Plans Under Section 80c To Reduce Your Tax Burden

Elss Mutual Funds 10 Best Elss Mutual Funds To Invest In 2021 22